The Summitpath Llp PDFs

The Summitpath Llp PDFs

Blog Article

The smart Trick of Summitpath Llp That Nobody is Discussing

Table of ContentsThe Best Guide To Summitpath LlpThe Only Guide for Summitpath LlpThe Best Strategy To Use For Summitpath LlpSome Ideas on Summitpath Llp You Need To Know

Most just recently, released the CAS 2.0 Practice Advancement Training Program. https://www.provenexpert.com/en-us/summitpath-llp/. The multi-step coaching program consists of: Pre-coaching alignment Interactive team sessions Roundtable discussions Embellished training Action-oriented mini intends Firms looking to increase into advisory services can likewise transform to Thomson Reuters Practice Onward. This market-proven method offers material, devices, and support for companies curious about consultatory solutionsWhile the modifications have unlocked a variety of growth opportunities, they have actually likewise resulted in obstacles and problems that today's companies require to carry their radars. While there's difference from firm-to-firm, there is a string of typical difficulties and concerns that have a tendency to run market broad. These include, but are not restricted to: To stay affordable in today's ever-changing governing atmosphere, companies must have the ability to promptly and effectively carry out tax obligation research and improve tax obligation coverage efficiencies.

On top of that, the new disclosures may lead to a rise in non-GAAP procedures, historically a matter that is highly scrutinized by the SEC." Accountants have a lot on their plate from regulative adjustments, to reimagined business models, to a rise in client assumptions. Equaling it all can be tough, but it does not have to be.

Examine This Report about Summitpath Llp

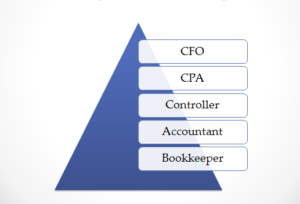

Below, we define 4 certified public accountant specializeds: taxation, management bookkeeping, financial reporting, and forensic audit. Certified public accountants specializing in taxation assist their clients prepare and submit income tax return, decrease their tax burden, and avoid making mistakes that can bring about pricey penalties. All Certified public accountants require some knowledge of tax obligation legislation, but focusing on taxation means this will certainly be the focus of your work.

Forensic accounting professionals normally start as basic accounting professionals and move right into forensic accountancy functions over time. They require solid analytical, investigative, business, and technological audit abilities. Certified public accountants that concentrate on forensic audit can often relocate up right into monitoring accounting. CPAs need a minimum of a bachelor's degree in accounting or a comparable field, and they have to complete 150 credit rating hours, including accountancy and business courses.

No states need a graduate level in accountancy. An accounting master's level can assist trainees satisfy the certified public accountant education need of 150 credit ratings given that most bachelor's programs just require 120 credits. Audit coursework covers subjects like finance - https://www.dreamstime.com/josehalley18_info, auditing, and taxation. Since October 2024, Payscale records that the ordinary yearly salary for a CPA is $79,080. CPA for small business.

And I liked that there are great deals of different task options which I would not be jobless after college graduation. Accountancy also makes practical sense to me; it's not just theoretical. I like that the debits constantly have to equal the debts, and the equilibrium sheet has to balance. The CPA is an important credential to me, and I still get proceeding education credit scores yearly to stay on top of our state requirements.

Summitpath Llp for Dummies

As a freelance professional, I still use all the standard foundation of accounting that click here to find out more I learned in university, pursuing my certified public accountant, and working in public audit. Among the important things I truly like regarding accountancy is that there are several work offered. I determined that I wished to start my job in public bookkeeping in order to find out a whole lot in a brief period of time and be revealed to different sorts of customers and different locations of audit.

"There are some workplaces that don't intend to take into consideration someone for a bookkeeping duty who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A certified public accountant is an extremely useful credential, and I intended to place myself well in the industry for different work - Calgary CPA firm. I chose in university as an accountancy significant that I wished to attempt to get my CPA as quickly as I could

I've fulfilled a lot of fantastic accounting professionals who do not have a CPA, however in my experience, having the credential really helps to promote your proficiency and makes a distinction in your payment and job choices. There are some work environments that don't desire to consider a person for an audit role that is not a CPA.

Fascination About Summitpath Llp

I really appreciated servicing various kinds of jobs with different clients. I learned a lot from each of my coworkers and customers. I dealt with various not-for-profit organizations and discovered that I have a passion for mission-driven organizations. In 2021, I determined to take the next action in my audit occupation trip, and I am now a freelance accounting professional and company consultant.

It proceeds to be a development area for me. One important high quality in being an effective certified public accountant is genuinely caring regarding your customers and their organizations. I like collaborating with not-for-profit clients for that extremely reason I seem like I'm really adding to their goal by helping them have great monetary information on which to make clever business choices.

Report this page